Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

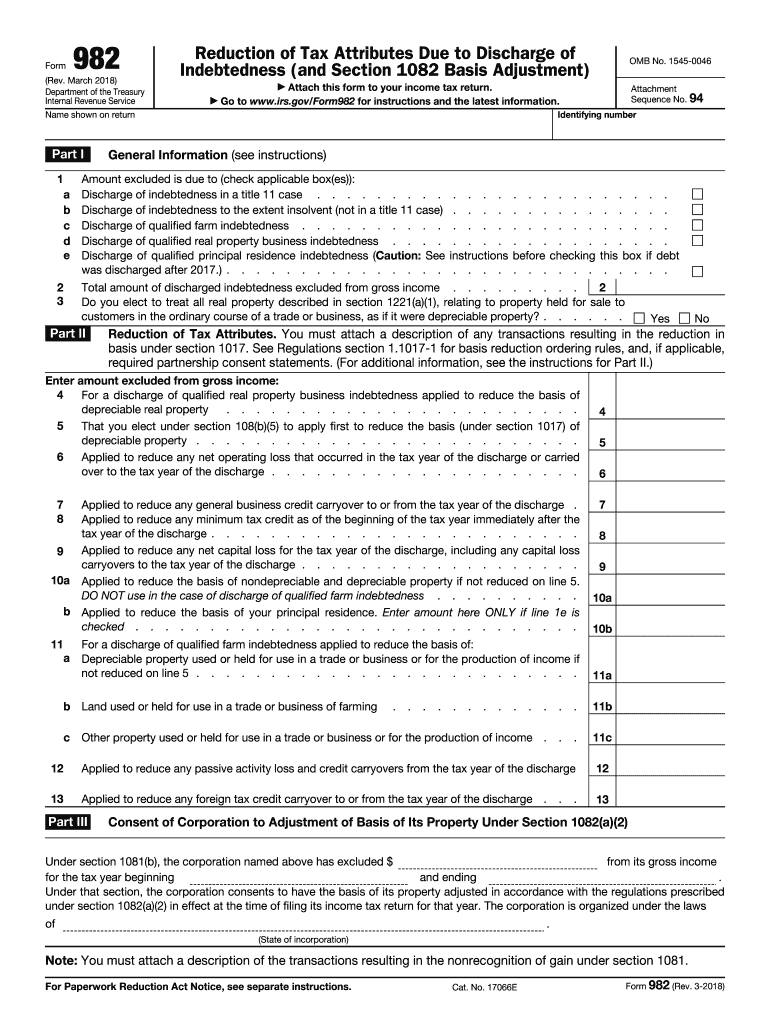

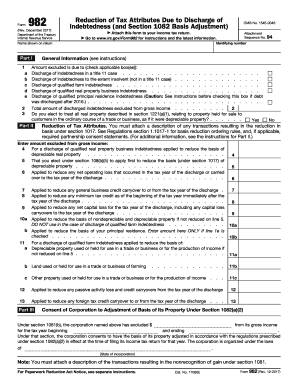

IRS Form 982 is an official form used to report the cancellation, discharge, or forgiveness of debt income. It is used by taxpayers to report canceled debt income that is excluded from their gross income. Form 982 also is used to figure the amount of any reduction to the taxpayer’s tax attributes due to the discharge or cancellation of debt.

What is the penalty for the late filing of irs form 982?

If you fail to file Form 982 by the due date, you may be subject to a late filing penalty. The penalty is normally 5% of the amount of the discharge of indebtedness for each month or part of a month that the return is late, up to a maximum of 25%.

Who is required to file irs form 982?

Individuals who have had their debt canceled, forgiven, or discharged may be required to file IRS Form 982. This form is used to report the amount of canceled debt excluded from income for tax purposes.

How to fill out irs form 982?

Filling out IRS Form 982 requires careful attention to detail. Here are the steps to help you complete the form accurately:

1. Understand the purpose: Form 982 is used to report the cancellation or forgiveness of debt in certain situations and to claim specific exclusions or exceptions from income.

2. Gather necessary information: Collect all relevant financial documents, such as 1099-C (if applicable), loan paperwork, and any other supporting documents related to the canceled or forgiven debt.

3. Identify the eligible exclusion or exception: Determine which section of Form 982 applies to your situation. There are several possible sections, including bankruptcy, insolvency, farm indebtedness, real property business indebtedness, qualified principal residence indebtedness, and others. Use the appropriate section based on your circumstances.

4. Complete Part I - Identification of the Exclusion: Provide your name, address, and Social Security number. In Line 1, check the box that corresponds to the section that allows you to exclude or reduce the canceled debt. If you don't qualify for an exclusion, enter the total amount of canceled debt on Line 2.

5. Complete Part II - Reduction of Tax Attributes: If you checked a box in Part I, go to Part II and complete it based on the section you chose. This section deals with reducing various tax attributes, such as the basis of assets, passive activity loss, and carryovers. Consult the instructions for Form 982 or seek professional tax advice if you need help in this section.

6. Complete Part III - General Information: Answer the questions in this section as they relate to your situation.

7. Determine if you need to file any supporting schedules: Depending on your circumstances, you may need to file additional schedules along with Form 982. For example, if you're claiming insolvency, you may need to complete Schedule 1 (Form 982) - Discharge of Indebtedness. Review the IRS instructions or consult a tax professional to determine if any additional schedules are required.

8. Review and sign: Carefully review every entry on the form to ensure accuracy and completeness. Sign and date the form when you are ready to submit it to the IRS.

9. Keep a copy: Make a copy of the completed Form 982 and all supporting documents for your records.

10. File the form: Submit the original Form 982 with any required attachments to the IRS at the appropriate address based on your tax return filing method (e.g., paper or electronic).

Remember, Form 982 can be complex, so if you're unsure about any part, it's always wise to consult with a tax professional or seek guidance from the IRS.

What is the purpose of irs form 982?

The purpose of IRS Form 982, also known as the Reduction of Tax Attributes Due to Discharge of Indebtedness (COD) worksheet, is to report and claim certain exclusions from income when a taxpayer has had debt canceled or forgiven by a lender. This form allows taxpayers to reduce the amount of taxable income resulting from the forgiven debt, ensuring that they do not pay taxes on money they no longer owe. Form 982 is typically required to be filled out and attached to the individual's federal tax return in the year that the debt was forgiven.

What information must be reported on irs form 982?

IRS Form 982, also known as Reduction of Tax Attributes Due to Discharge of Indebtedness, has specific information that must be reported. Here is the key information required:

1. Identify the taxpayer: Fill in your name, Social Security Number (SSN), and address.

2. Check the appropriate box: Indicate whether you are an individual, partnership, corporation, or other entity.

3. Part I – General Information:

- Explain the discharged debt: Provide a description of the discharged debt and the date it was canceled.

- Identify the creditor: Include the name, address, and taxpayer identification number (TIN) of the creditor who canceled the debt.

- Determine the total amount of canceled debt: Report the total amount of discharged debt that you are excluding from your taxable income.

4. Part II – Election to Reduce Tax Attributes:

- Determine if you need to adjust tax attributes: Figure out if you were insolvent immediately before the discharge of debt and whether you qualify for any other exclusions.

- Reduction of tax attributes: Calculate the amount by which your tax attributes are reduced, if applicable, and report it in this section.

5. Part III – Explanation of Insolvency:

- Provide a detailed explanation: Explain your insolvency at the time the debt was discharged. List your assets and liabilities to support your insolvency claim.

6. Sign and date the form: Sign and date the form to certify that the information provided is true and accurate.

It is important to consult a tax professional or refer to the IRS instructions for Form 982 to ensure accurate reporting based on your specific situation.

When is the deadline to file irs form 982 in 2023?

The general deadline to file IRS Form 982, also known as the Reduction of Tax Attributes Due to Discharge of Indebtedness, falls on April 17th, 2023, for most taxpayers. However, it's essential to note that tax deadlines can vary based on individual circumstances, such as filing status, residency, and extensions. It's always advisable to consult with a tax professional or visit the official IRS website for the most accurate and up-to-date information regarding specific deadlines.

Can I create an electronic signature for signing my form 982 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your form 982 for and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the irs form 982 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign instructions 982 form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit 982 on an iOS device?

Create, edit, and share form 982 irs from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.