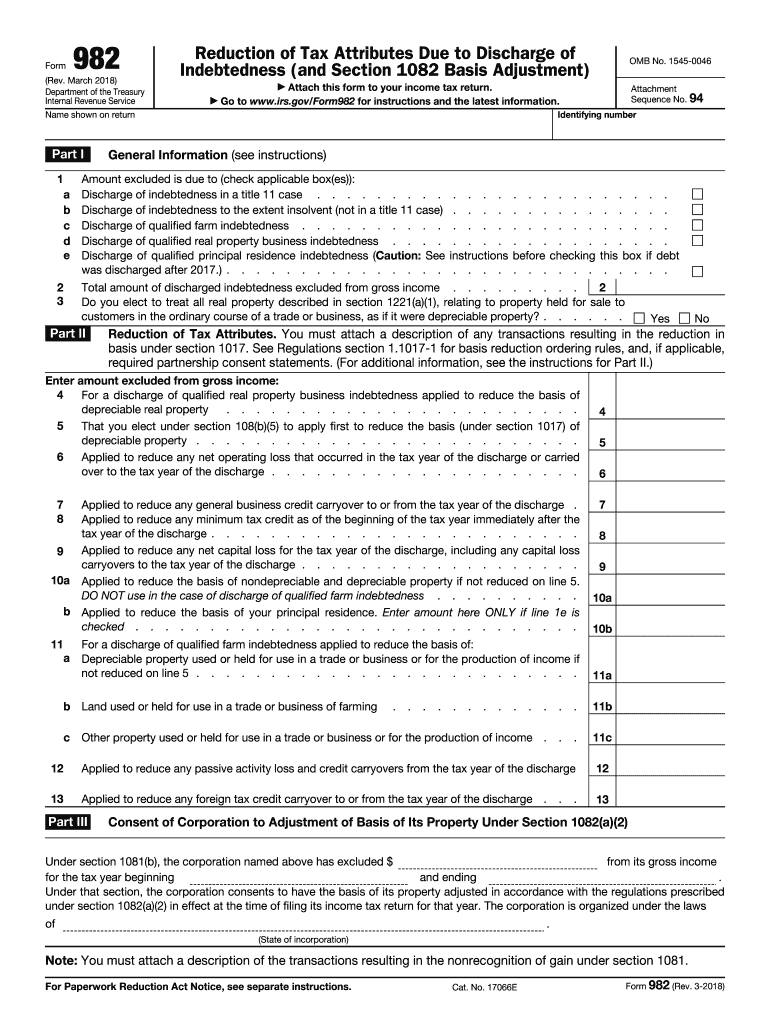

What is Form 982?

Under particular circumstances described in section 108 of the Internal Revenue Code, a taxpayer can exclude the amount of discharged indebtedness from their gross income. IRS Form 982 (or Reduction of Tax Attributes Due to Discharge of Indebtedness) is used to report the exclusion and the reduction of specific tax attributes, either dollar for dollar or 331/3 cents per dollar.

Who should file Form 982 2024?

The record must be filed by taxpayers who have received 1099-C (Cancellation of Debt) and are eligible to exclude canceled debt from their income.

What information do I need to file the 982 Form?

Filers can prepare the following information to accelerate the process of filling out the template:

- Their name and identification number

- The reason for discharging debt and its total amount

- Details about reduction of tax attributes

- Consent of corporation to adjustment on the basis of its property

How do I fill out Form 982 in 2025?

Use the following form 982 instructions to prepare the document correctly:

- Click the orange Get Form button at the top of the page.

- Indicate your name and Identifying number in the first fillable fields on the page.

- In Part I, provide general information about the total excluded amount and reasons for it. Click the checkboxes to select or deselect items.

- Indicate reduction of tax attributes in Part II. Click on fillable areas and enter information. Navigate between fields using the Enter or Tab keys.

- Fill out the blanks in Part III.

- Select Done on the top right corner of the screen.

- Choose the exporting method and click to get the file in your preferred format.

Is Form 982 accompanied by other forms?

A taxpayer should attach this record to their income tax return.

When is IRS Form 982 Due?

File this record with a federal tax return for the year a debt was forgiven. Usually, it is April 15.

Where do I send 982 forms?

File this document with a federal tax return and send it to the Internal Revenue Service office that serves your region. Taxpayers can find their offices on the IRS official website.